AML Screening for Investment & Financial Services Firms

Enhanced Compliance and Immediate Insights for Informed Decisions

Fortifying Investment and Financial Services

Fortifying Investment and Financial Services

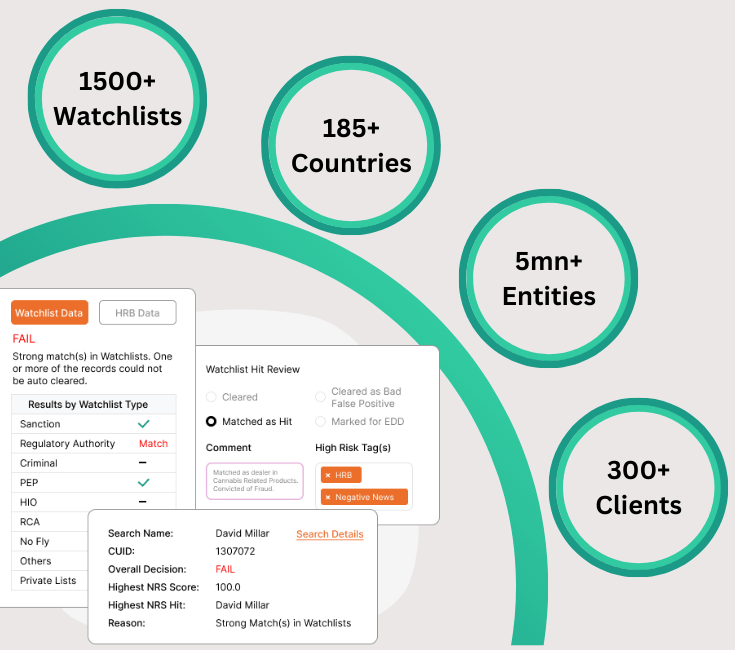

We bring solutions that will make it easier for our customers worldwide to comply with AML Regulations.

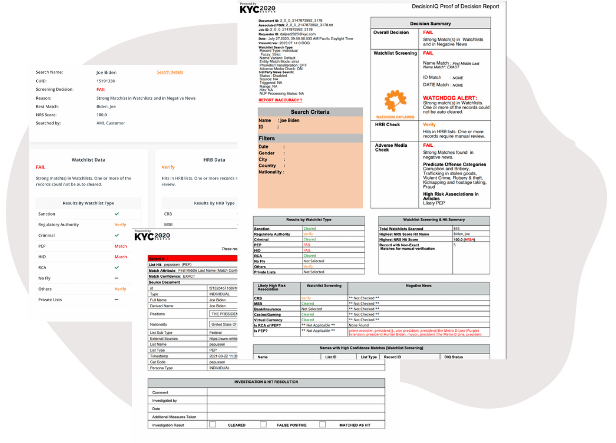

In today's stringent regulatory landscape, maintaining a clear audit trail is paramount. Our platform offers verifiable auditability, allowing financial institutions to trace and document every screening decision. From initial screening to ongoing monitoring, our solution generates comprehensive and tamper-proof audit trails. This ensures transparency, accountability, and compliance with regulatory requirements. Stay at peace knowing that your institution's screening processes are fully documented and auditable, providing a solid foundation for risk management and regulatory reporting.

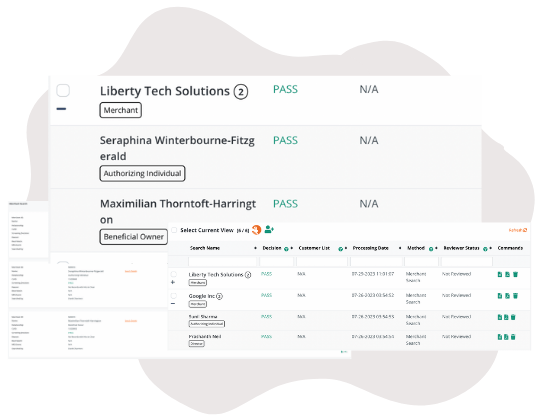

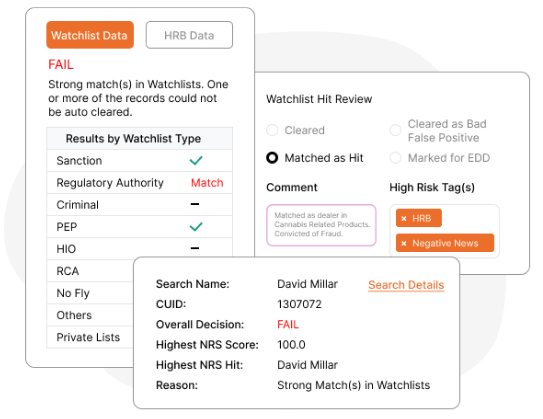

Introducing DecisionIQ, featuring an intuitive user interface meticulously crafted to optimize workflows. As your business scales, our adaptable interface seamlessly integrates and efficiently adapts, enhancing your operational agility. Immerse yourself in a user-friendly platform empowering your team to effortlessly navigate complex processes. Experience heightened efficiency and unwavering compliance confidence with DecisionIQ

Harnessing our advanced screening technology, we've carefully designed a streamlined 3-step process tailored specifically for investment firms. Rapidly identifying potential Sanctions, PEPs, and Adverse Media risks, our solution is powered by real-time data coverage and sophisticated algorithms. This comprehensive compliance framework seamlessly adapts to the ever-evolving regulatory landscape of your industry, ensuring optimal alignment with your requirements. Watch the video to learn more.

Watch the video to learn more about our screening technology

Our AI-powered Adverse Media Check® swiftly identifies individuals, companies, and PEPs with negative news, safeguarding your firm's reputation. Say goodbye to slow onboarding and false positives from search engines and legacy systems. With sophisticated AI algorithms and ongoing learning, we ensure comprehensive monitoring and sentiment analysis. Elevate your customer onboarding and risk management with confidence.

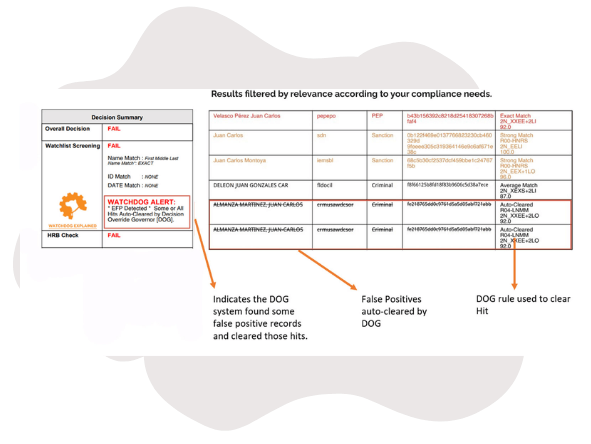

Amplify the power of AI with human intelligence through our KYC2020 Watchdog system. In financial services and investment companies, AI may fall short in handling complex edge cases, but with Watchdog, our Human Intelligent rule-based system takes the lead. Seamlessly integrated with KYC2020 DecisionIQ AI, Watchdog ensures optimal screening results by combining AI-driven efficiency with human expertise. Customize rules for precise risk-based screening, and leverage our proprietary scoring and filtering capabilities. Automated False Positive clearing and in-depth analysis ensure a compliant and streamlined process, empowering your team to tackle the most intricate challenges effectively.

Our comprehensive AML screening encompasses sanctions, PEP, watch lists, and adverse media, customized to determine precise customer risk levels – a necessity, particularly for high net worth individuals requiring heightened risk assessment. Beyond the initial screening, our ongoing scheduled batch assessments ensure timely notifications of changes, enabling robust risk management and preserving financial integrity.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance