KYC2020 Solutions

From AML data to screening decisions, KYC2020's intelligent screening and scoring has it all.

Use Smart Data and Next-Generation technology over the cloud to drive innovation and efficiency

License our data or use it as part of our advanced AML Screening service

At the forefront of our AML screening solutions stands DecisionIQ, our advanced technology platform designed to revolutionize your compliance efforts. DecisionIQ harnesses the latest advancements in AI and human factors engineering to streamline your AML screening processes. With a focus on efficiency, accuracy, and scalability, DecisionIQ redefines the way businesses navigate complex regulatory landscapes.

Watch the video to learn more about our screening technology

DecisionIQ aggregates data from global watchlists, sanctions, PEP lists, adverse media, and more. This extensive coverage ensures that you have a holistic view of potential risks associated with entities and individuals.

Real-time screening capabilities empower you to make informed decisions swiftly. DecisionIQ's lightning-fast searches allow you to identify high-risk entities in a matter of seconds, minimizing exposure to potential threats.

Advanced pattern recognition filters enhance the precision of your screenings. DecisionIQ intelligently identifies name variations, misspellings, and transliterations, ensuring accurate matches and reducing false positives.

Our platform includes a specialized scoring system for Arabic names, detecting diacritics and unique name parts within Arabic script. This feature enhances name matching accuracy and compliance with intricate lists.

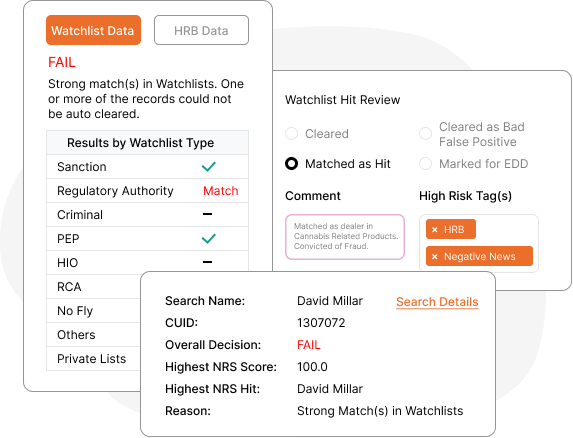

Integration with our Rapid Clearing and Review system within DecisionIQ enables bulk clearing and streamlined case management. AML officers can manage thousands of records seamlessly from a single screen, saving time and enhancing productivity.

The intuitive interface of DecisionIQ makes it easy for compliance teams to navigate complex searches and screenings. Our RestFUL API helps build better workflows and automates your AML Compliance regime.

In a rapidly evolving regulatory landscape, DecisionIQ is your partner in achieving effective AML compliance. With its powerful features, Collaborative Intelligence based technology, and commitment to accuracy, DecisionIQ empowers businesses to safeguard their operations, reputation, and financial integrity.

Address the unique challenges of Cannabis Related Businesses (CRBs) with our specialized screening solution. CRBs present substantial risk due to their alignment with FINCEN's high-risk category, stringent regulatory oversight throughout their operations, federal prohibition, and controversial reputation. Our solution helps you navigate these complexities effectively, ensuring compliance and minimizing risk exposure.

Read More

Elevate your due diligence with our comprehensive KYB screening solution. Access 145 global government registries, offering accurate insights into over 220 million legal entities and 300 million corporate officers. Uncover beneficial ownership, organizational structure, and verify businesses. Stay compliant and make informed decisions with KYC2020.

Read MoreOur HRB Check® solution is designed to streamline the identification and management of High Risk Businesses (HRBs). Following FINCEN guidelines, it focuses on factors such as MSBs, Casinos, and Online Gaming. By integrating specific watchlists from VisionIQ, including regulated authority lists and state/provincial licensing data, our solution ensures accurate HRB recognition. This approach prevents potential errors in customer onboarding and strengthens risk control measures.

Read More

Our automated daily monitoring system empowers businesses to stay vigilant without manual effort. It conducts continuous screening against OFAC and select sanctions lists. This proactive approach ensures that any changes in the risk profile of your clients are promptly identified, allowing timely intervention to mitigate potential threats. With real-time alerts, you can maintain compliance seamlessly and respond swiftly to any evolving risks.

We understand that every business has its unique risk tolerance and needs. Our scheduled ongoing monitoring feature allows you to tailor the frequency of screenings based on your risk assessment. Whether it's weekly, monthly, or quarterly, you can customize the monitoring intervals to match your compliance requirements. This flexibility ensures that you have a well-balanced risk management strategy, focusing resources where they matter most while adhering to regulatory standards.

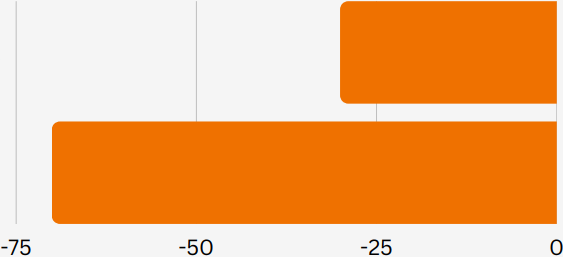

Our customers report over 30%

reduction in overall cost of sanction

screening and monitoring when they

switch.

Cost

75% reduction in false positives

that reduces your manual work.

False Positives

DecisionIQ and KYC2020's team of AML specialists made it very easy for us to get started hands-free!

Tracy Van Dijk

CPA,CGA, Director

VisionIQ DaaS is comprehensive and reliable. The watchlists are monitored and updated regularly

Bilal Ramjaun

CFO

The KYC sanction list screening API solution was a perfect fit for integration into our AML program!

Roman Halushchak

General Manager

We needed a watchlist screening solution that was built for scale and could speed up our customer onboarding. KYC2020's DecisionIQ delivered!

Amie Mcphee

Sr Director

As a cryptocurrency company, AML compliance is very important to us. KYC2020's DecisionIQ provides us with efficient, compliant data and searches while allowing us to provide a seamless as possible customer experience - 10/10 would recommend.

Frank Maione

Founder & CEO

When it came to compliance with money laundering and financial crime, we just did not want to do the bare minimum, we wanted to follow best practices...

Maxim Galash

CEO

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance