AML Screening for Foreign Exchanges and Remittances

Unveiling Clarity in Compliance for Forex and Remittance Companies

Empower Safe Transactions and Shield Reputations with Advanced AML Screening for Forex and Remittances

Empower Safe Transactions and Shield Reputations with Advanced AML Screening for Forex and Remittances

We bring solutions that make it easier for customers worldwide to comply with AML Regulations.

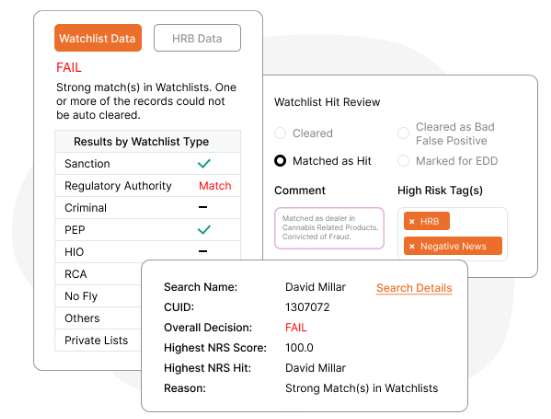

Enhance the precision of your forex and remittances screening process with our tailored solutions. Our advanced algorithms meticulously analyze sanctions, PEPs, watch lists, and adverse media, minimizing false positives and maximizing accurate risk assessment. Real-time monitoring ensures proactive risk management, enabling you to make informed decisions while reducing operational disruptions. Elevate your compliance standards and confidently navigate the complexities of forex and remittances with streamlined efficiency.

Safeguard your forex and remittances operations with our robust adverse media screening. Our platform scans a vast array of 10000+ global news sources and databases, identifying potential reputational risks associated with individuals and entities. By swiftly flagging adverse mentions, you can promptly assess and mitigate potential threats, ensuring compliance and protecting your business from undue exposure. Stay ahead of emerging risks and maintain your financial integrity with our comprehensive adverse media screening solution.

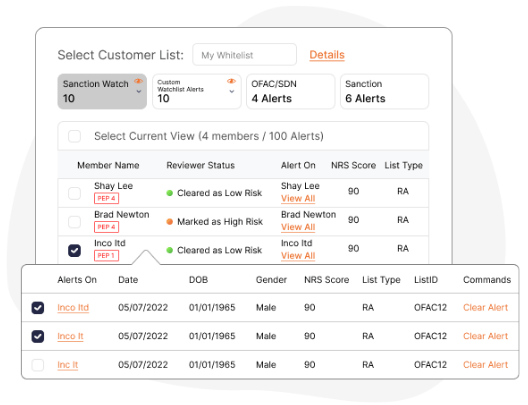

In the dynamic landscape of foreign exchange and remittances, real-time ongoing monitoring is essential to mitigate risks. KYC2020 offers a solution that ensures your operations are consistently aligned with compliance standards. Our advanced Ongoing monitoring system alerts you to any anomalies or changes in customer status promptly, allowing for swift intervention and proactive risk management.

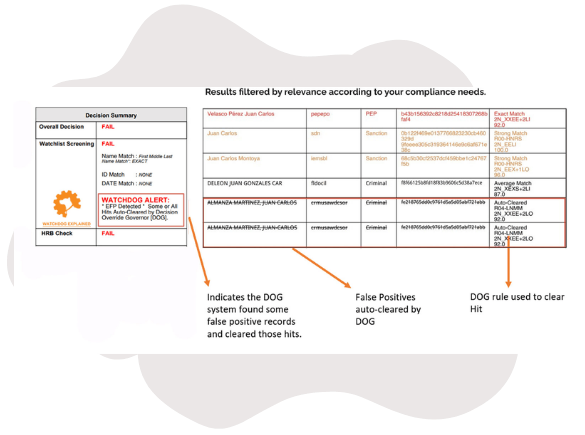

In the dynamic realm of currency exchanges, seamless customer onboarding is vital. Our WatchDog automates the clearance of false positives by applying customizable rules. This smart functionality automatically clears results based on pre-defined parameters, ensuring accurate and efficient decision-making. Elevate your onboarding process while maintaining rigorous compliance standards using Decision Override Governor.

The currency exchange and remittances industry is subject to dynamic regulatory shifts. KYC2020 provides a vigilant solution to keep you compliant at all times. Our advanced technology enables swift adjustments to evolving regulations. With real-time updates and adaptable screening methodologies, you can confidently navigate changing compliance landscapes and stay ahead of regulatory requirements.

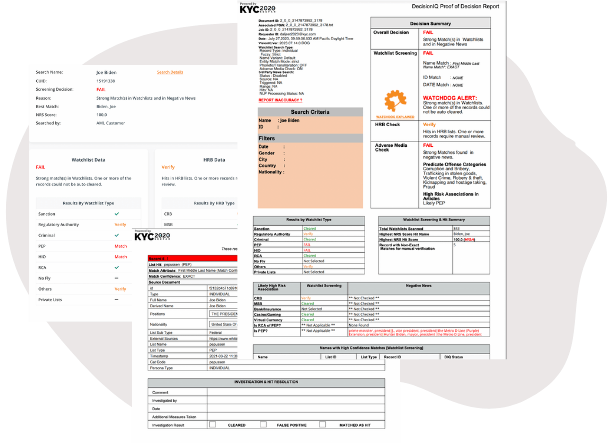

Our AML solution ensures you stay audit-ready with robust reporting tools. Generate accurate, detailed reports showcasing your compliance efforts effortlessly to regulatory authorities. These reports provide a transparent snapshot of your compliance journey. Seamlessly navigate audits, reinforcing your commitment to regulatory compliance.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance