REDUCE THE OVERALL COST OF WATCHLIST SCREENING

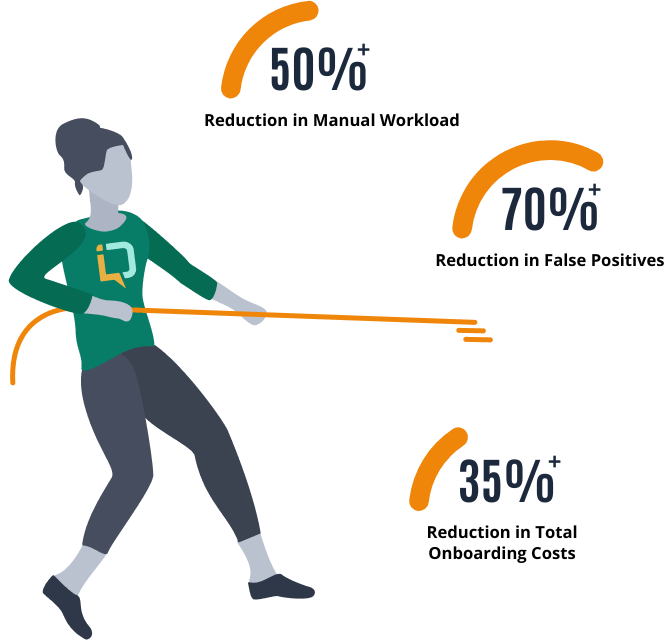

Stop manually clearing false positives and speed up client onboarding Discover the DecisionlQ Advantage!

AI-based systems have not delivered on the promise

Solutions lack verifiable auditability and transparent decisioning

Screening is slow, manually intensive, and high friction

Ongoing monitoring is redundant rescreening with high false alerts

Screen against 1000's of news sources and over 1500 Sanction, PEP and Regulatory watchlists to get a screening decisions backed by verifiable and transparent "proof of decision"

Combines the best of Artificial and Human Intelligence

Delivers real-time screening decisions via API

Auto-clears false positives to lower manual effort and overall costs

Provides verifiable auditability via 'proof-of-work'

Low false positives with proprietary scoring system that is superior to fuzzy

Designed for quick integration with an API-first approach

Affordable subscription options that suit any budget

Highly customizable per your risk-based approach

Built-in rapid review and case management to expedite manual workflows

Multiple ways to interface via Web, Batch, or API

Support for negative news and high-risk business screening

Built for Data Privacy and GDPR compliance

Agnostic screening regime

Compliance staff required

Inefficient and costly

High friction to customer onboarding

Not GDPR Compliant

Rescreening with false alerts

Lack of Decision Tranparency

Risk-based approach

75% Reduction in manpower

Cost-effective

Rapid customer onboarding

Data Privacy

Intelligent Persistent Monitoring

Verifiable Auditability

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance