KYC2020 Uses Next-Generation Technology To Help Customers Reduce Cost And Friction Associated With Traditional AML Compliance Solutions.

HRB Check ensures financial institutions have solutions to identify cannabis-related businesses

Below is our recent interview with Rajeev Bahri, Co-Founder and Managing Director of KYC2020:

Q: Rajeev, can you tell us something about the company and your AML Compliance solutions?

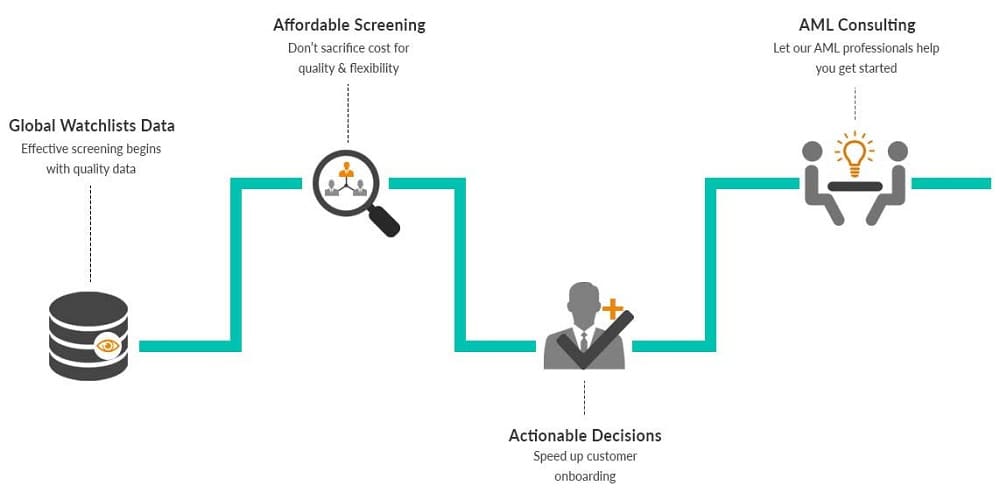

A: KYC2020 was founded in 2016 to meet the sanction screening requirements of Small & Medium Size Enterprises (SMEs) and Emerging Payments FinTech that lacked viable and affordable AML compliance solutions. We use next-generation technology to help our customers reduce the cost and friction associated with traditional compliance solutions and help them speed up their customer onboarding. Our current solutions include a global watch list and PEP database, a watchlist filtering service, and a sanction screening decision service.

Our customers can license our watchlist data to use with their existing screening solutions, use our cloud-based screening service for watchlist filtering and scoring, or let our intelligent systems manage the paperwork and clearing of false positives and go completely hands-free with our sanction screening decision service.

We also have a team of CAMS™ and VSKILLS™ certified AML specialists that offer Risk Assessment and other AML compliance related consulting services, but that’s not our bread and butter.

Recommended: Meet The Passionate Team Behind The Hit Word Puzzle Game Pictoword

Q: You use the term ‘SMEs’ to describe your customers. What do you mean by that?

A: In the past, AML compliance was limited to banks. Today, any business that handles money or financial assets must in the very least conduct sanction screening against global watch lists to be compliant with regulations and avoid penalties. This includes small and middle-sized enterprises (aka ‘SMEs’) such as PSPs, MSBs, FX Brokers, Investment Managers, Art Dealers, Real Estate Brokers, Travel Agents, Casinos, Charitable NGOs, Online Merchants, Virtual Currency Exchanges, ICOs, and more.

As you can imagine with the rise in online sales and emergence of crypto currency there has been an explosion in demand for faster customer onboarding and friction-less payment services. FinTech are on the move to meet this demand. Many are also working towards the mission of financial inclusion. They are banking the unbanked, building micro-lending platforms, providing low-cost money remittance services to migrant workers, and more. All these businesses require transaction cost-efficiency as the critical factor for success.

Fintech are innovating the financial systems and demand innovation in regulation technology (i.e. RegTech). What they have currently was designed for banks over 30 years and is just not suitable for too many reasons to talk about here. If you are interested in learning more about the challenges faced by SMEs, read my whitepaper.

Q: If you say compliance technology in banking is outdated. Why not target banks as customers?

A: It’s not that we don’t want to target banks as customers. It’s just that our product build strategy was initiated by a specific market sector demand. This target market has unique needs. The needs are often simpler to address, but serving SMEs requires a new type of thinking focused around cost and customer experience.

Banks are a different animal altogether. They often want to be cutting edge innovators, but have legacy issues and need highly integrated screening systems. Change is slow, cost and process efficiency is debated but often ends up taking a back seat to the “don’t fix it if it ain’t broke” mentality, especially if it is not a new revenue generator. And compliance is not a revenue generator. Banks have the ability to either absorb the costs of inefficiency or pass the cost on to their customers. Change eventually happens and we will be there for that. My co-founder Joseph and I have over 50 years of combined positive experience with selling and supporting solutions into financial services.

Our current focus is non-bank financial institutions. We understand them well, and they quickly recognize the value proposition and product differentiators once they demo and look at our pricing plans.

Q: Ok let’s talk about your solutions now. Can you give us more insights?

A: Our team of CAMS™ certified AML specialists have combined next-generation technology with our deep understanding of MSBs, ICOs, and Cryptocurrency operations to deliver AML solutions that are low friction, affordable, and most importantly, compliant. We have an ambitious product roadmap, but wanted to start with attacking the biggest pain point for most non-bank financial firms— the need for a sophisticated and affordable sanction screening solution. ‘Sophisticated’ meant that we had to build bottom up with next-generation technology, and ‘Affordable’ meant that we had to build our own database. Sourcing the sanction and PEP data from the 2-3 established enterprise sources meant that we could not control the pricing of the overall solution. This is the reason we started in 2016 by first building VisionIQ, our global watch list database, then SmartScan, our watchlist filtering and scoring service, and most recently, DecisionIQ, our sanction screening decision service. A bit more about our products:

● VisionIQ is our proprietary database with over 1000 global watch lists, including Sanction, PEP, Terrorist, Enforcement, and Criminal Lists. Data is cleaned, normalized and regularly updated for use by our screening services.

● SmartScan is our watchlist filtering solution. It is incredibly smart, flexible, and affordable. It is easy to use and easy to interface. Interface options include ad-hoc search via Web UI, batch processing, and API. SmartScan™ is built on Elasticsearch™ with an industry proven smart search and scoring engine that is easy to configure based on customer AML Risk Profile. It minimizes false positives and fits ANY budget.

● DecisionIQ is our AI and ML based decisioning system. DecisionIQ takes a risk-based approach to deliver real-time actionable decisions on whether to pass or fail screened individuals or entities. Each decision is backed by an auditable proof-of-work that is transparent and securely stored. DecisionIQ automates the manual task of clearing false positives and dealing with audit documentation that must be retained as proof of decision rationale. DecisionIQ helps our resource tapped clients reduce costs, improve operational efficiencies, and speed up customer onboarding.

No matter what product you choose, all our solutions are available as Platform-as-a-Service (PaaS) and are easy to get started. From a pricing standpoint, we offer simple, flexible, and custom options that can suit any budget. Our least expensive Pay-As-You-Go plans are well suited for startups. For our mid-sized firms and MSBs, we offer multiple annual subscription plan options depending on the transaction volume and interface requirements. No matter what plan you choose, we guarantee that we are the highest quality, most affordable solution around.

Q: So Why KYC2020? What makes you stand out from your competition?

A: That’s a good question and one that we think about a lot. There is plenty of competition, but the good news is that RegTech and AML compliance is a rapidly expanding pie.

I believe that differentiating yourself starts with first knowing your customer, building for their needs, and then rapidly evolving. In our case, we were clear about our target customer and built our solutions from ground up to specifically meet their needs.

Our biggest competitive advantage is that our customers do not have to make a choice between quality and affordability. I would claim that we are the most flexible, highly sophisticated, easy to interface, full function enterprise class sanction screening solution available at the lowest cost. Our annual sanction screening subscriptions are 1/8th the price of most quality enterprise solutions.

We are able to do this because unlike our competition, we build and manage our own sanction and PEP database. Most other RegTech solution providers targeting this customer segment do not have the resources, foresight, or technical sophistication to build and maintain their own data. They have to source and license that through the 2-3 enterprise data vendors. This can be expensive.

Cost is often a short-term and short-lived advantage. That is why we are constantly innovating. I believe our long-term advantage is going to be our decisioning technology that will move watchlist filtering from a semi-automated ‘search and screening’ concept to a real-time fully automated decisioning concept.

Q: You talk about moving from ‘traditional’ screening tools to ‘Decisioning’ services. What exactly do you mean by that?

A: The end goal of sanction screening is to get to a decision— the decision to onboard a customer or to approve a transaction. Early in our development cycle we realized that “screening” was an old world concept that invariably required manual review for clearing false positives to get to decisions. To put it another way, screening is simply a tool for humans to arrive at a decision. You can add risk threshold based rules to screened results to arrive at a decision, but that does not turn it into a decision system. Hence our push towards ‘decisioning’ services that are far more sophisticated and use next-generation technology such as AI and ML to constantly improve decision outcomes.

We recognized that our customers needed to get to screening decisions as quickly and effortlessly as possible without manual review and without compromising compliance. This was the genesis for DecisionIQ, our sanction screening decision service. The service delivers pass/fail decisions, automatically clears false positives, provides complete transparency on the decision making process, and in the rare cases where human review is required for decisioning, the system has an active workflow and an intuitive UI for rapid processing of decisions.

The numbers speak for themselves. In our alpha and beta trials, our customers achieved over 80% time and cost efficiency with DecisionIQ over their traditional sanction screening.

Q: What are your plans for the future?

A: We are currently working on three (3) fronts. On the data front we are improving our watchlist management and monitoring systems, building our PEP, HIO, and RCA databases, and beginning work on our Adverse Media data strategy. On the SmartScan and sanction screening front we are working on adding more processing capacity and working through our customer wish lists for enhancements and additional workflows to help manage the AML compliance life cycle.

What I am personally most excited about is our upcoming Risk Assessment Based In Transaction decisioning system, code named ‘Hello Rabbit.’ This AI based improvement in DecisionIQ is designed to dynamically assess and determine search rules, risk thresholds and watchlist criteria based on the client and transaction risk factors. This approach will reduce unnecessary ‘over screening’ of customers and transactions. The system design follows a risk-based approach for optimum compliance while greatly reducing the overall computation costs and processing times. “Hello Rabbit” will be the basis for our real-time transaction monitoring system for AML/CFT compliance.